Australia / New Zealand Application - What documents do I need?

This guide will help you understand what documents you need while filling in your application for Australia or New Zealand.

Providing your Business ABN (Australian Business Number) or NZBN (New Zealand Business Number)

To be successful in your application for payments with Worldpay for platforms you will need a valid ABN (Australian Business Number) or NZBN (New Zealand Business Number).

Where can I find my ABN or NZBN?

Your ABN is a unique 11-digit number or NZBN is a 13-digit number, and can usually be found by:

Checking your business invoices

Looking at letters sent to your business by the government

Using the free business look up tool AUS (https://abr.business.gov.au ) or NZ (https://www.nzbn.govt.nz/ ) provided by the local Government

What do we use it for?

We use an ABN or NZBN verification tool to verify your business details. In some instances, this method may help prefill some important information and save you time in applying. It also helps prove that your company is legitimate and registered in Australia or New Zealand.

What information do we verify?

Company Legal Name and Trading Name

Details of your directors, ultimate beneficial owners (UBO’s) and/or controllers.

This information is only shared with us for the purpose of validating your business and processing your application.

Please note if you cannot provide an ABN, or do not have one, we cannot process your application at this time

Business Banking Details

WorldPay for Platforms is required to verify your business’ bank account and confirm which accounts you want to use for billing and settlements with us.

There are two main ways to verify your bank accounts:

Electronic verification: This is where you will be provided a link to validate your business bank account details.

Manual verification: This is where you will supply a current banking institute copy of your business bank statement. Alternatively, you can supply a banking institute account opening letter.

Please ensure the document you provide is dated within 3 months and is a verified document from your banking institute. Your bank account details including Account Name, BSB and Account Number must be visible on the document you provide, and the Account Name must match the name of the legal entity you are applying for.

Pricing, Services, and Transaction Information

Worldpay for Platforms will require information pertaining to the products and services that you intend to process through our merchant facility. We have regulatory requirements to understand your business’ transactions processed through our platform.

You will need to provide:

A description of the goods and services you provide

A summary of your most common payment terms, including whether you accept payments in arrears or advance and if so, how many days in advance

The average value of your transactions, and the highest single transaction amount you expect to process with us

How many transactions/purchases do you expect to process in one month on average

Allocating fees and confirming pricing

Worldpay for Platforms provides your business fee options:

Business paid fees: This is where you accept the fees for the transactions.

Payer paid fees: This is where the fees are passed onto your customers.

A combination of the above

This will be displayed as a table, with a checkbox to digitally authorise you have seen the pricing before you submit your application. Depending on your account, you may also need to allocate how you want to split your fees between your business and your customers.

Once the application has been approved, your Authorised Representative or director/s will receive a copy of the application, including your fee setup and pricing.

Authorised Representatives and Beneficial Owners

As part of verifying your business, we need to confirm the details of any individual who is:

A Director or Authorised Controller of your business

A beneficial owner, with 25% or greater ownership in your business

Depending on your business setup, you may not have any beneficial owners (such as not-for-profit or charity organisations). If this is the case, you need to submit the details of at least one Authorised Controller.

Providing details of Owners, Directors, and Authorised Representatives

Worldpay for Platforms requires your Ultimate Beneficial Owners (those with 25% or more share in your company), Directors, and/or Authorised Controllers to confirm their personal details and provide a form of identification to be able to proceed with your application.

To verify a person’s identity, we require the following:

Full Name

Date of Birth

Residential Address

Ownership % (if they are an Owner)

Role in Business

A copy of identification is also required:

Current Australian or New Zealand Driver’s License

Current Australian or New Zealand passport

How do Worldpay for Platforms verify your current identification:

Biometrics: you will be provided an SMS link to a 3rd party software to enter your personal ID details, and you will be validated in real time. We recommend this option as this is the fastest way to validate your identity.

Manual upload: You will be able to manually upload a copy of your identification documents for manual review with our team. This can slow down the application process.

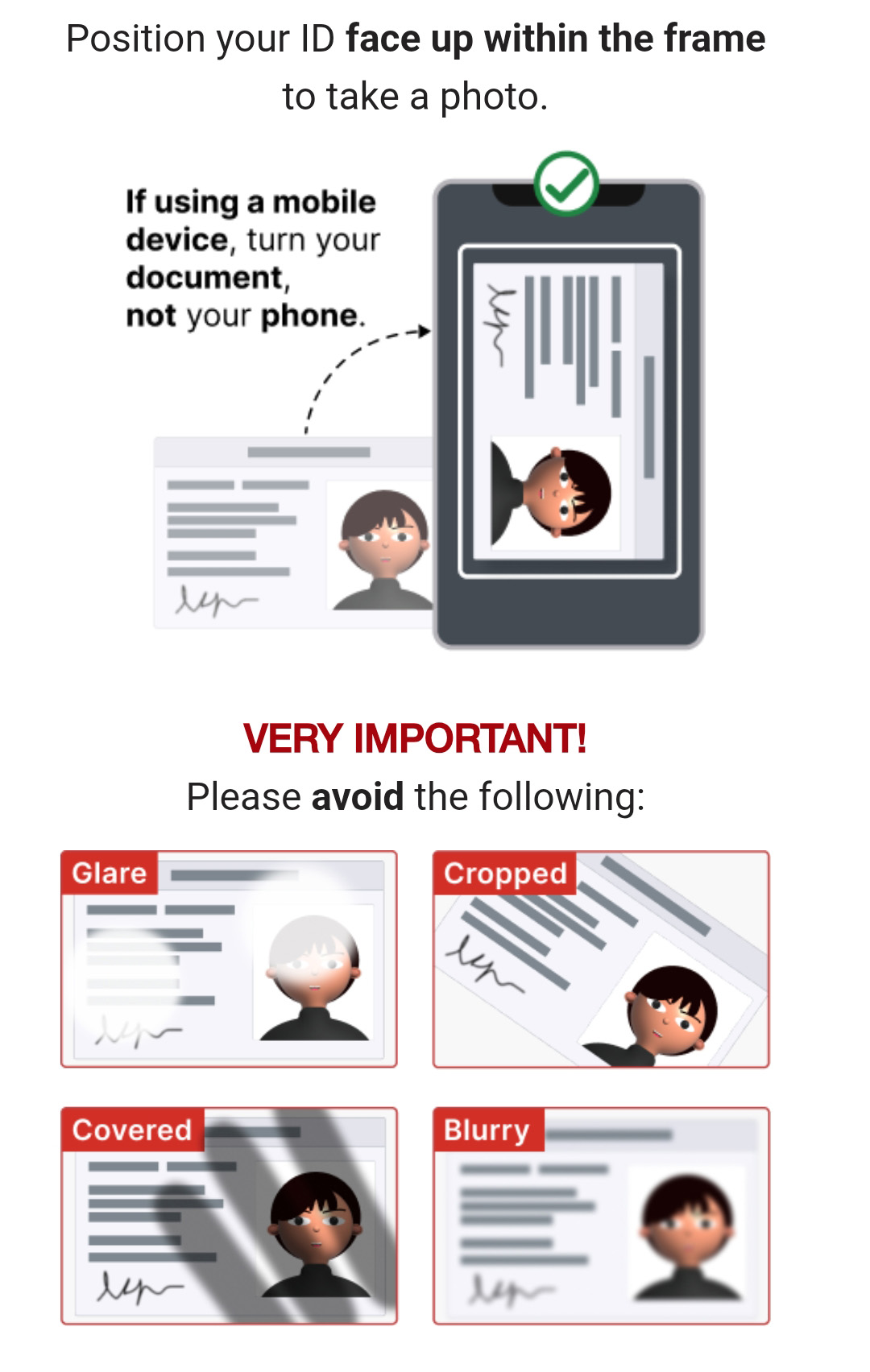

Identification Guidelines

To verify your identity, please follow the prompts provided in the Biometrics SMS that you will receive.

Within the process you will be informed on what to look out for when capturing the images. We require an optimal image to help validate your identity.

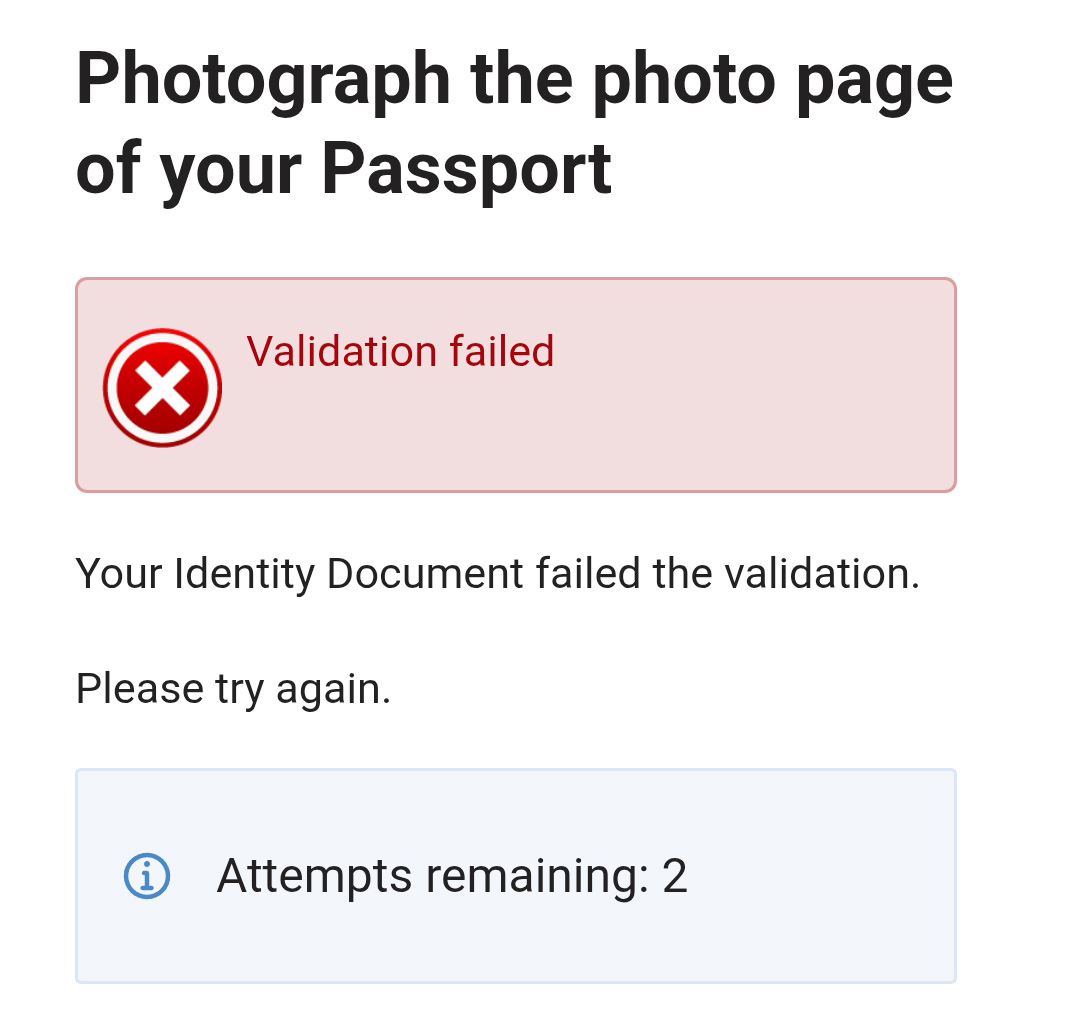

If there are any issues within the Identification process you will receive a notification to try again, like below.

Once your identity has been captured successfully you will receive the flowing notice.

Application acceptance

At the final stage of onboarding, Worldpay for Platforms requires a minimum of 1 director, owner and/or controller to sign and authorise your application for your business to receive financial services from Worldpay for Platforms.

Once this acceptance has been signed, a copy of our FSG, terms & conditions and a copy of your application form, will be sent via email.

Need Help?

If you require any assistance throughout the onboarding process, please reach out to our friendly account management team on 1300 592 283.

%20(1).png)